LIVE: “Cut income taxes by 15% for the average Canadian” https://www.youtube.com/watch?v=Z66mfrqempw

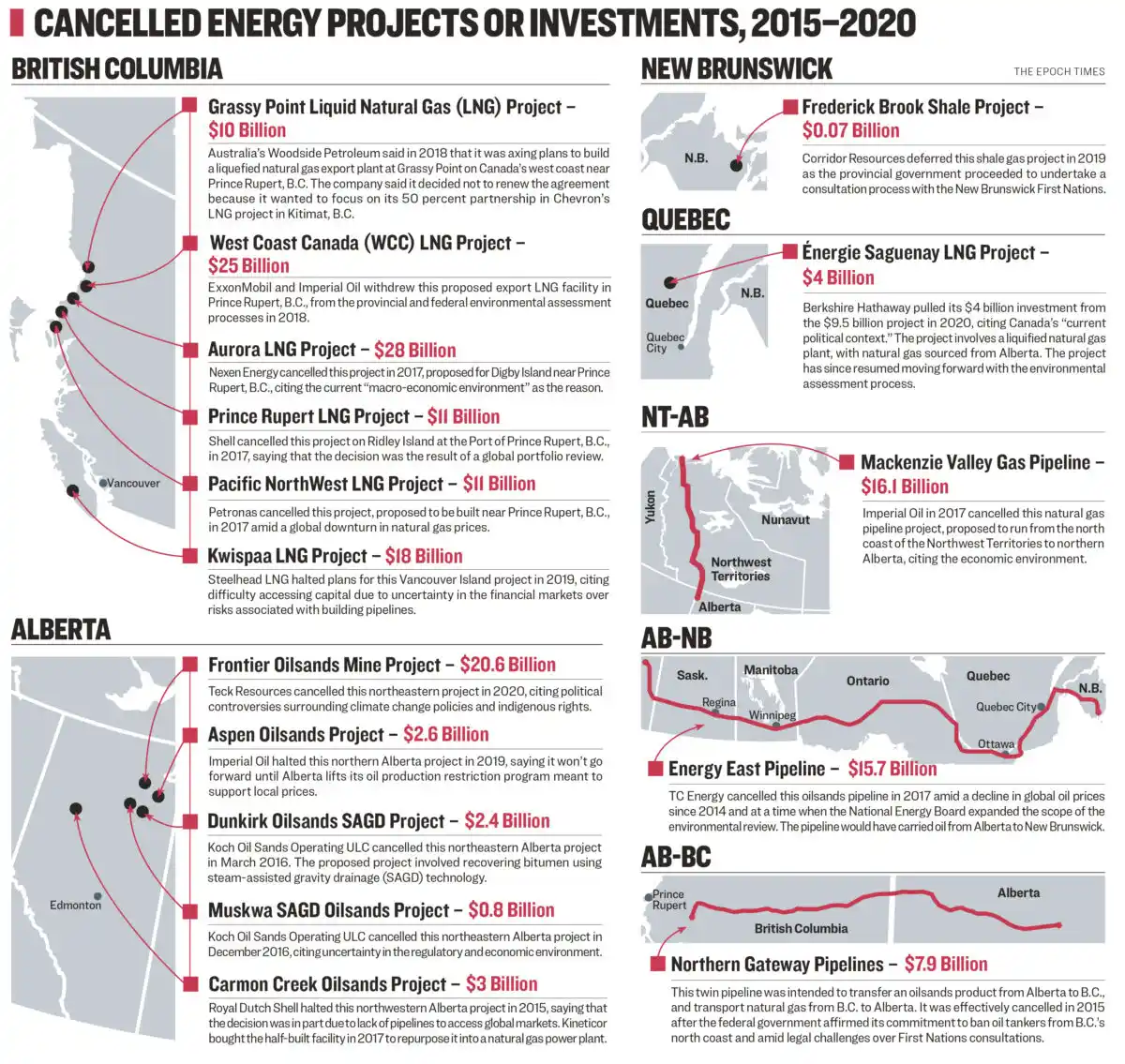

🔻 1. Loss of Investment in Energy and Resource Projects

🔻 2. Collapse in Private Business Investment

-

🔗 Title: “Foreign investors are still investing in Canada, but even more money is leaving.” (Business Council of Alberta) https://businesscouncilab.com/insights-category/economic-insights/foreign-investors-are-still-investing-in-canada-but-even-more-money-is-leaving/

Canada also lost out on private sector FDI. Confidence vanished under the Liberal government.

❌ No foreign direct investment in manufacturing, tech, agribusiness, or even real estate.

💼 International investors don’t base their decisions on who Boomers vote for — they look at policy execution, not sentiment or marketing of new candidate.

📉 The “Trudeau–Mark Carney Liberal Party” has become a red flag for serious capital.

The selection of Mark Carney didn’t reassure anyone — the investors don’t look at the PM candidate like Boomers do.

What investors care about is policy — the real, on-the-ground ability of a government to get resource and energy projects approved, built, and monetized through exports that generate national revenue.

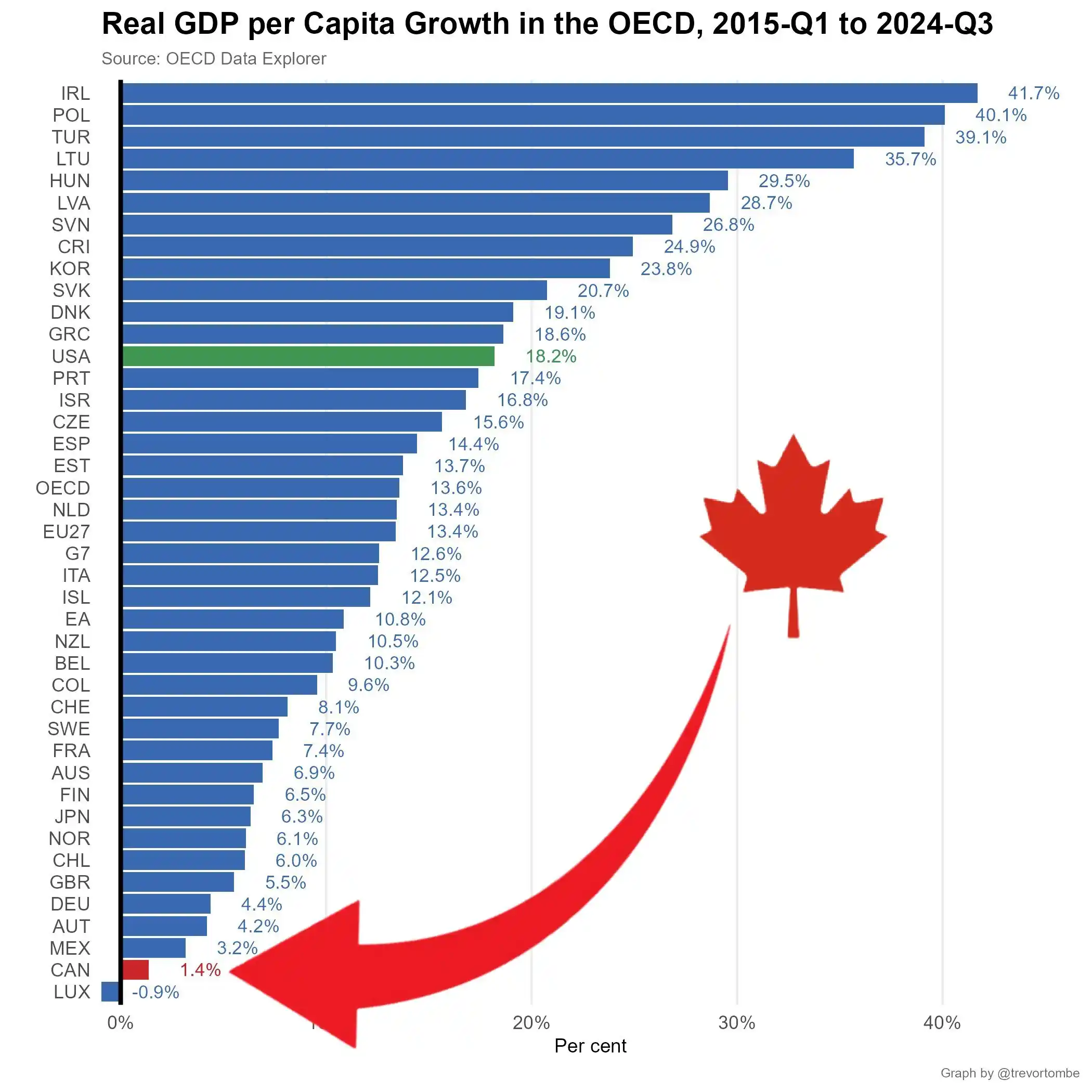

🔻 3. Uncoupling from U.S. Stock Market = Missed Wealth for Millions

Even worse: Canada’s stock market flat-lined while U.S. markets soared.

📉 International investors pulled out after seeing $670B in energy investment vanish.

💡 They knew: no resource growth = no energy growth = no exports = no national wealth. So they left. And Canadian equities flat-lined as well.

🧓 Retirees and pensioners lost a decade of compound growth. Even tech companies suffered from poor market confidence, as there was no liquidity in their tech stock, to drive their business growth, and so they were not able to develop new products and services (Ex: Blockchain, & AI).

🏠 Boomers might think their house price went up. But it’s the same house.

📉 Their portfolios, however, are down hundreds of thousands in potential growth compared to U.S. counterparts, since the Canadian index flat-lined, as inflation soared, and did not keep up to massive US growth in equities (which would have protected the inflation properly).

💰 That’s real — and painful — wealth loss. Portfolio looks better than a decade ago, but Canadians are not wealthier people.

4.🔻The Dollar: Silent Killer of Canadian Prosperity 📉

-

2013-01-04 = 1.01

-

2014-01-06 = 0.93

-

2015-01-05 = 0.85

-

2016-01-20 = 0.68

-

2017-01-05 = 0.76

-

2018-01-05 = 0.81

-

2019-01-04 = 0.75

-

2020-01-06 = 0.77

-

2021-01-05 = 0.79

-

2022-01-04 = 0.79

-

2023-01-05 = 0.74

-

2024-01-05 = 0.75

-

2024-11-14 = 0.71

-

Harper-era average (2006 – 2015): 1 CAD ≈ $0.95 USD

-

March 24, 2025: 1 CAD ≈ $0.6976 USD

(0.950.95−0.6976)×100 ≈ 26.6%

Canada’s international purchasing power — wages, savings, retirement funds — were quietly gutted.

If anyone sells their house now, or their investment portfolio, and tries to buy anything in Canada or in any country on Earth, they will buy very little.

📉 Seniors lost over a quarter of their portfolios’ real value just in the currency of it, let alone the massive losses since it decoupled from American equity growth.

💸 Workers’ wages were effectively slashed by inflation.

🧒 And worst of all? These losses are permanent — inflation doesn’t reverse. It locks in damage for generations.

-

Direct investment flight — 💸 $500B to $670B gone.

-

Stock market stagnation — 📈 Missed gains, eroded pensions.

-

Currency devaluation — 💱 -26.6%, affecting every Canadian’s purchasing power.

🔻Result: No Real GDP Growth

Title: “When someone claims that “Canada’s National debt vs GDP is just as bad as the US,” they’re using a narrow accounting metric that doesn’t tell the whole story.” https://x.com/SkillsGapTrain/status/1891847552728813967

Cause(s): Real GDP flat-line (no growth), Military Decline Since 1990, Industrial/Export Decline Since 2015, International Investment Decline Since 2015, Import Supply Chain Dependence (China), Export Supply Chain Dependence (USA), Primary Resource/Energy/Wealth Zone in 21st Century (Canada)

Title: “The Strategic Importance of Canada in World War 3” https://skillsgaptrainer.com/strategic-importance-canada-ww3/

Title: “The power disparity has grown dangerously wide. This isn’t just about Trump. He’s not the only one eyeing Canada’s strategic vulnerability. We’re seeing an alarming rise in foreign influence and hostile takeover attempts from foreign nations and supranational institutes — across multiple fronts.” https://x.com/SkillsGapTrain/status/1904161443970441375

🧨 Final Message:

So Pierre, it’s not just half a trillion. The Liberals cost Canada far more — in prosperity, in opportunity, in dignity and it’s future.

🇨🇦 Question: What Does Foreign Direct Investment (FDI) Cover in Canada?

🛢️ 1. Resources & Energy Sector

-

Oil sands

-

LNG projects

-

Pipelines

-

Mining operations

-

Exploration ventures

🏢 2. Private Businesses (Non-Resource Sectors)

-

Manufacturing

-

Real Estate Developments

-

Agribusiness

-

Retail Expansions

-

Tech and Fin-tech Ventures

📈 3. Stock Market / Equities

-

If a foreign investor buys stocks or bonds in Canada (like on the TSX), it counts as portfolio investment, not direct investment.

-

But FPI often follows FDI trends: If foreign firms are pulling out of real infrastructure and energy, stock investors follow. Stagnation in Canadian equities post-2015 is part of this broader capital flight trend.

-

Energy & Resource Projects

✅ Included in FDI ✅ Directly Responsible for Lost Growth

-

Private Sector Businesses

✅ Included in FDI ✅ Confidence Loss = Investment Loss

-

Stock Market / Equities

❌ Not FDI (classified as FPI instead) ✅ Still Eelevant — Flat Performance = Wealth Loss

Related Video:

Related Content:

Title: “LIVE: Cut income taxes by 15% for the average Canadian” https://www.youtube.com/watch?v=Z66mfrqempw

Title: “Billions lost in ditched resource projects” https://www.resourceworks.com/billions-ditched-projects

Title: “Foreign investors are still investing in Canada, but even more money is leaving.” (Business Council of Alberta) https://businesscouncilab.com/insights-category/economic-insights/foreign-investors-are-still-investing-in-canada-but-even-more-money-is-leaving/

Title: “Strengthening Canada’s Energy Exports from Coast to Coast: How Canada’s Oil & LNG Infrastructure Can Mitigate Hyperinflation Risks” https://skillsgaptrainer.com/strengthening-canadas-energy-exports/

Title: “Canada’s Wake-Up Call: Boosting Our Economic Future” https://skillsgaptrainer.com/canadas-wake-up-call/

Title: “The Cost of Carbon: Financial Risks for Canada’s Surface Combatant Project” https://skillsgaptrainer.com/the-cost-of-carbon/

Title: “Canada’s Energy Ambitions: Can Doubling Exports Propel It to Global #1?” https://skillsgaptrainer.com/canadas-energy-ambitions/

Title: “Engineer-Level Accountability: A 100-Point Report Card on Liberal Governance (2015 – 2025)” https://skillsgaptrainer.com/engineer-level-accountability/

Title: “Revolutionizing Energy Resilience: Harnessing Distributed Micro Reactors for Urban & National Security” https://skillsgaptrainer.com/revolutionizing-energy-resilience/

Title: “Navigating the Crossroads of Crisis: A Comprehensive Comparative Analysis of Canadian Policy Platforms in an Era of Global Turbulence” https://skillsgaptrainer.com/navigating-the-crossroads-of-crisis/

Title: “Strategic Decision-Making for National Leadership: A Logical Economic Approach” https://skillsgaptrainer.com/strategic-decision-making-for-national-leadership/

Title: “Canada at a Crossroads in 2025: A Comprehensive Academic Examination of 20 Interconnected Crises” https://skillsgaptrainer.com/canada-at-a-crossroads-in-2025/

Title: “Blue Storm Rising: A Canada-Wide Industrial Renaissance“ https://skillsgaptrainer.com/blue-storm-rising-industrial-renaissance/

Title: “The CARBON TAX as a Foundational Barrier to Canada’s Prosperity and Sovereignty” https://skillsgaptrainer.com/the-carbon-tax-as-a-foundational-barrier/

Title: “The Environmental Impact of Canadian Immigration: A Hidden Contributor to Climate Change“ https://skillsgaptrainer.com/environmental-impact-of-canadian-immigration/

Title: “Safeguarding Canada’s Future: Addressing Economic Stagnation, Defense Vulnerabilities, & National Identity” https://skillsgaptrainer.com/safeguarding-canadas-future/

Title: “Blue Storm Rising” Master Report: A Comprehensive Framework for Alberta’s Industrial Miracle” https://skillsgaptrainer.com/blue-storm-rising-albertas-industrial-miracle/

Title: “Blue Storm Rising: The Quiet Force Within”https://skillsgaptrainer.com/blue-storm-rising/

Fix the broken countries of the west through increased transparency, design and professional skills. Support Skills Gap Trainer.’

To see our Donate Page, click https://skillsgaptrainer.com/donate

To see our YouTube Channel, click https://www.youtube.com/@skillsgaptrainer