1. Introduction

2. Hyperinflation: Causes, Consequences, and Canada’s Position

2.1 Understanding Hyperinflation

-

Excessive money printing to finance large deficits [3^33].

-

Rapid loss of confidence in the national currency.

-

Severe supply shocks or destruction of productive capacity.

2.2 Canada’s Vulnerabilities and Strengths

-

Earning stable foreign exchange (e.g., USD, EUR).

-

Attracting international investment in energy projects.

-

Maintaining a positive trade balance, which can bolster the currency and signal market confidence.

3. The Case for Coast-to-Coast Pipeline & LNG Expansion

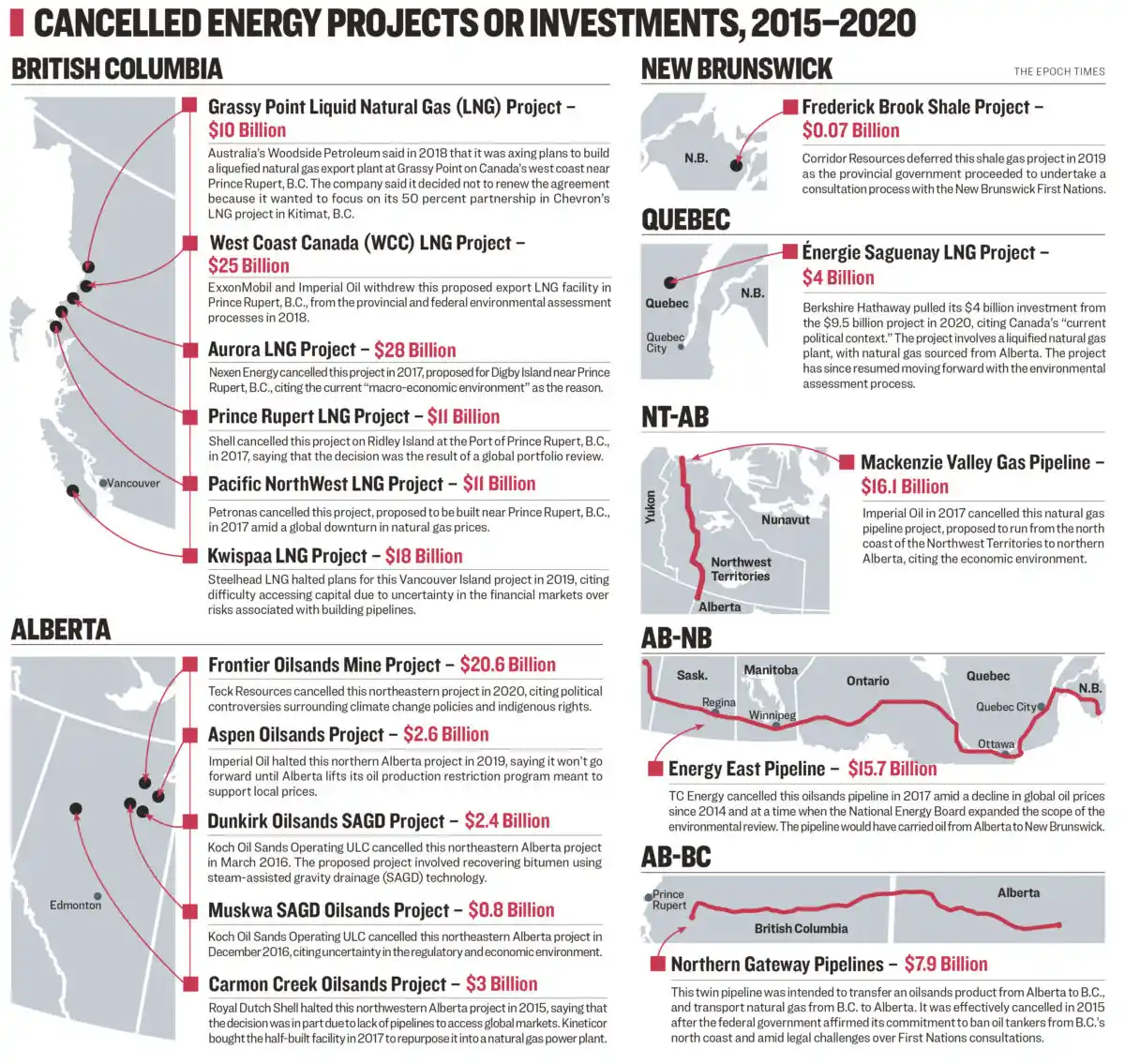

3.1 Historical Context: Major Cancelled or Suspended Energy Projects (2015 – 2025)

-

Northern Gateway Pipeline Proponent: Enbridge Location/Route: From Bruderheim, Alberta, to Kitimat, British Columbia Estimated Capital: ~CAD 7.9 billion Status: Cancelled (November 2016)

-

Energy East Pipeline Proponent: TC Energy (formerly TransCanada) Location/Route: From Hardisty, Alberta, to Saint John, New Brunswick Estimated Capital: ~CAD 15.7–16 billion Status: Cancelled (October 2017)

-

Keystone XL Pipeline Proponent: TC Energy (formerly TransCanada) Location/Route: From Hardisty, Alberta, to Steele City, Nebraska Estimated Capital: ~CAD 8 billion Status: Terminated (June 2021)

-

Pacific NorthWest LNG (Petronas): Location: Lelu Island near Prince Rupert, BC Estimated Capital: CAD 11 – 36 billion Status: Cancelled (July 2017)

-

Aurora LNG (Nexen, INPEX, Sinopec) Location: Digby Island, near Prince Rupert, BC Estimated Capital: Up to CAD 28 billion Status: Cancelled (September 2017)

-

Prince Rupert LNG (BG Group → Shell) Location: Prince Rupert, BC Estimated Capital: ~CAD 11 billion Status: Shelved / application withdrawn

-

Grassy Point LNG (Various Asian partners) Location: North of Prince Rupert, BC Estimated Capital: ~CAD 10 billion Status: Stalled / never advanced to full regulatory approval

-

WCC LNG (Imperial Oil & ExxonMobil) Location: Tuck Inlet, near Prince Rupert, BC Estimated Capital: Up to CAD 25 billion Status: Cancelled (application withdrawn)

-

Kitimat LNG (Chevron/Woodside) Location: Bish Cove near Kitimat, BC Estimated Capital: CAD 15 – 20 billion Status: Indefinite hold

-

Kwispaa LNG (Steelhead LNG, Huu-ay-aht First Nations) Location: Port Alberni, Vancouver Island, BC Estimated Capital: ~CAD 10 billion Status: Effectively cancelled (~2020)

Note: Ksi Lisims LNG (Nisg̱a’a Nation, Rockies LNG, Western LNG) is still under feasibility and thus not included as cancelled.

-

Frontier Oil Sands Mine (Teck Resources) Estimated Capital: ~CAD 20.6 billion Status: Cancelled (Teck withdrew application in 2020)

-

Aspen Oil Sands (Imperial Oil) Estimated Capital: ~CAD 2.6 billion (Phase 1) Status: Deferred/“on hold” since 2019

-

Dunkirk SAGD Project Estimated Capital: ~CAD 2.4 billion Status: Suspended

-

Muskwa SAGD Project Estimated Capital: ~CAD 0.8 billion Status: Shelved / cancelled

-

Carmon Creek Project (Shell) Estimated Capital: ~CAD 3 billion Status: Cancelled in 2015

-

Keystone XL Pipeline (TC Energy) Estimated Capital: ~CAD 8 billion Status: Terminated mid-2021

-

Pierre River Mine (Shell) Estimated Capital: ~CAD 10+ billion Status: Suspended in 2015; application withdrawn (2017)

Additional suspended projects include Joslyn North (TotalEnergies), initially paused in 2014, then fully exited ~2018; ~CAD 11 billion cost.

-

Frederick Brook Shale Estimated Capital: ~CAD 0.07 billion (exploration) Status: Suspended by 2016 due to provincial moratorium on fracking

-

Énergie Saguenay (GNL Québec) Estimated Capital: ~CAD 9–14 billion Status: Denied provincial environmental approval in 2021; cancelled by mid-2022

-

Mackenzie Valley Gas Pipeline Estimated Capital: ~CAD 16.2 billion Status: Officially cancelled after decades of planning

-

Energy East Pipeline (TC Energy) Estimated Capital: ~CAD 15.7 – 16 billion Status: Cancelled (October 2017)

-

Northern Gateway Pipeline (Enbridge) Estimated Capital: ~CAD 7.9 billion Status: Cancelled (November 2016)

-

Goldboro LNG (Pieridae Energy) Estimated Capital: ~CAD 10 billion Status: Officially postponed (2021)

-

Bear Head LNG (LNG Limited) Estimated Capital: ~CAD 2–5 billion Status: Not formally cancelled, but effectively stalled

Capital Impact

3.2 Additional Cancellations: Proposed Oil Refineries and Smaller LNG Export Terminals (2015–2025)

-

Kitimat Clean Refinery Proponent: David Black (private consortium) Location: Near Kitimat, British Columbia Estimated Capital: CAD 22–30 billion Status: Proposed around 2012–2013, never advanced to formal regulatory or financing stages; effectively cancelled by 2017–2019.

-

Pacific Future Energy Refinery Proponent: Pacific Future Energy Corp. Location: Northwest BC (near Prince Rupert/Terrace) Estimated Capital: CAD 10–15 billion Status: Proposed in 2014 as a “near net-zero” bitumen refinery; no final investment decision was ever reached. Dormant since ~2018.

Refinery Subtotal: ~CAD 32–45 billion in cancelled or indefinitely deferred projects.

Cancelled or Deferred Small-Scale LNG Terminals

-

Douglas Channel LNG Proponent: BC LNG Export Co-operative (various backers) Location: Douglas Channel near Kitimat, BC Estimated Capital: ~CAD 0.5–1 billion Status: Multiple attempts at revival (2012–2017) failed; project cancelled with no updates post-2018.

-

Malahat LNG (Steelhead LNG) Proponent: Steelhead LNG (also behind Kwispaa LNG) Location: Saanich Inlet, Vancouver Island, BC Estimated Capital: ~CAD 1–2 billion Status: Proposed in 2015; faced local opposition and regulatory hurdles. Steelhead’s collapse around 2020 ended the project.

Small-Scale LNG Subtotal: ~CAD 1.5–3 billion in cancelled or indefinitely deferred projects.

Combined Capital Range

-

Refineries: ~CAD 32–45 billion

-

Small-Scale LNG: ~CAD 1.5–3 billion

Implications and Observations

-

Underdeveloped Downstream Capacity: Canada’s reliance on existing refineries has persisted partly because new large-scale refining projects struggle with high costs, stringent regulations, and uncertain market returns.

-

Local LNG Ambitions: Smaller LNG initiatives aimed at niche markets or floating LNG solutions were similarly hampered by low global LNG prices (especially during 2015–2017) and a complex regulatory environment.

-

Aggregate Impact: While modest relative to mega-projects like Pacific NorthWest LNG or Energy East, these refineries and smaller terminals underscore the broader pattern of lost or deferred investment in Canadian energy infrastructure.

3.3. Estimating a High-End Total: Summary

-

Group the Projects by Category Major Cross-Province Pipelines (e.g., Northern Gateway, Energy East, Keystone XL). Large BC LNG Proposals (e.g., Pacific NorthWest LNG, Aurora LNG, Prince Rupert LNG). Alberta Oil Sands Projects (e.g., Frontier Mine, Aspen SAGD, Joslyn North). Other Regional Megaprojects (e.g., Énergie Saguenay in Quebec, Mackenzie Valley Pipeline). Proposed Oil Refineries (e.g., Kitimat Clean, Pacific Future Energy). Smaller LNG Terminals (e.g., Douglas Channel LNG, Malahat LNG).

-

Use Publicly Stated “High-End” Costs Many project cost ranges are broad (e.g., “$11–$36 billion”). Assume the upper bound to reflect Canada’s history of budget overruns in large infrastructure ventures.

-

Avoid Double-Counting Some projects, like Keystone XL, appear in multiple lists (pipelines and oil sands). Only include them once.

-

Sum Each Category’s Upper Bound Major Pipelines alone approach $30–$35 billion. Large BC LNG proposals, taken at high-end estimates, can exceed $140 billion collectively. Alberta Oil Sands projects add another $50 billion or more. Other Regions (Quebec, NWT, Nova Scotia, New Brunswick) total roughly $45 billion. Refineries (Kitimat Clean, Pacific Future) top $40–$45 billion. Smaller LNG proposals add about $3 billion. When combined, these totals approach $315 billion.

-

Factor in Potential Cost Overruns Canadian mega-projects often exceed their original budgets by 10 – 30%. Even a 10% overrun on $315 billion pushes the total near $350 billion.

-

Why the Big Difference from Earlier “$150 – $250 Billion” Ranges? Earlier estimates often used average or midpoint cost figures. Some proposals were discounted because they never reached serious financing or final investment decisions. This high-end approach reflects the maximum possible foregone investment if every project had been fully built at its top-range estimate.

-

Key Conclusion A $300 – $350 billion figure underscores the immense scale of unrealized hydrocarbon-export capacity in Canada. Even if only half these projects had been built (with typical cost overruns), the combined investment would still far exceed $150 billion. Policymakers weighing the economic resilience benefits of oil and gas infrastructure — even as a hedge against severe inflation — should keep in mind the magnitude of these deferred or cancelled projects

3.4 Implications for Economic Turbulence

-

Currency and Trade Balance: Losing these large-scale export opportunities can weaken Canada’s ability to earn foreign exchange, a key factor in shoring up currency stability during inflationary or hyper-inflationary crises.

-

Employment and Investment: Delayed or cancelled projects forego thousands of potential jobs, local business growth, and broader economic multipliers — particularly relevant in times of volatility.

-

Geopolitical Leverage: Having robust, coast-to-coast pipelines and LNG capacity provides flexibility to pivot exports to different global markets, potentially insulating Canada from geopolitical supply shocks.

3.5 Economic Rationale in a High-Inflation World

3.5.1 Foreign Exchange Earnings

-

Stabilizing the Canadian dollar against speculative attacks.

-

Enhancing investor confidence, as strong foreign reserves often correlate with lower country risk premiums.

3.5.2 Trade Balance & Fiscal Space

3.5.3 Investment & Job Creation

-

Create thousands of direct and indirect jobs (in engineering, construction, and operation).

-

Attract substantial capital investment, both domestic and international.

4. Environmental and Indigenous Considerations

4.1 Environmental Stewardship

-

Support global energy security, especially during transitional periods of supply volatility.

-

Generate revenues that can be invested in clean-energy R&D and modernizing Canada’s energy grid.

4.2 Indigenous Partnerships

-

Economic self-determination for Indigenous nations via equity stakes and long-term revenue sharing.

-

Protective oversight of environmental and cultural resources, leveraging traditional ecological knowledge.

5. The Limitations of Energy Exports as a Hyperinflation Panacea

5.1 Hyper-inflation’s Primary Drivers

5.2 Long Project Timelines

5.3 Market Volatility & Price Risks

6. Policy Recommendations

-

Revitalize Key East-West Pipeline Projects: Revisit the Energy East concept or similar proposals for transporting Western Canadian crude to Atlantic refineries and export terminals. Engage with stakeholders (provinces, municipalities, Indigenous nations) from the earliest stages to streamline consultations and regulatory processes.

-

Accelerate LNG Export Terminals: Support and expedite the development of coastal LNG facilities on both coasts (e.g., British Columbia, Nova Scotia). Offer fiscal incentives for private sector investment in Canada’s LNG infrastructure, prioritizing low-emission facility designs (e.g., electrification, carbon capture).

-

Strengthen Environmental & Indigenous Frameworks: Mandate best-available spill prevention and monitoring technologies to reduce ecological risks. Ensure Indigenous equity participation, job training, and revenue-sharing agreements become standard practice.

-

Build a Sovereign Energy Fund: Channel a portion of resource-export revenues into a sovereign wealth fund, as practised in Norway [10^1010]. Invest returns in diversifying the domestic economy, stabilizing budgets during bust cycles, and funding R&D for clean-energy transitions.

-

Coordinate Monetary-Fiscal Policy: Keep resource-driven currency inflows from fuelling an overvalued Canadian dollar (the so-called “Dutch Disease” [11^1111]. Improve coordination between the Bank of Canada and the Ministry of Finance to prevent inflationary overshoots, maintaining credibility in times of global uncertainty.

7. Conclusion

-

Bolster its foreign exchange reserves,

-

Strengthen its trade balance,

-

Drive investment and job creation, and

-

Better navigate global volatility, including extreme inflationary risks.

References

-

Hanson, R. (1998). The Great Filter—Are We Almost Past It? Retrieved from http://mason.gmu.edu/~rhanson/greatfilter.html

-

Cagan, P. (1956). The Monetary Dynamics of Hyperinflation. In M. Friedman (Ed.), Studies in the Quantity Theory of Money (pp. 25–117). University of Chicago Press.

-

Reinhart, C., & Rogoff, K. (2009). This Time Is Different: Eight Centuries of Financial Folly. Princeton University Press.

-

Bank of Canada. (2021). Monetary Policy Report. https://www.bankofcanada.ca/

-

Canada Energy Regulator. (2022). Cancelled and Completed Pipeline Projects. https://www.cer-rec.gc.ca/

-

International Monetary Fund. (2022). World Economic Outlook: Countering the Cost-of-Living Crisis. https://www.imf.org/

-

Bordo, M. (2002). The History of Monetary Unions. Routledge.

-

Intergovernmental Panel on Climate Change. (2022). Sixth Assessment Report. https://www.ipcc.ch/

-

Indigenous Advisory and Monitoring Committee (IAMC). (2019). Principles for Indigenous Engagement in Energy Projects. https://www.iamc-tmx.com/

-

Norfund. (2020). Norway’s Sovereign Wealth Fund: History and Evolution. https://www.nbim.no/

-

Davis, G. A. (1995). Learning to Love the Dutch Disease: Evidence from the Mineral Economies. World Development, 23(10), 1765–1779.

Related Content:

Title: Report: “Optimizing Economic Efficiency through Resource & Energy Exports, Technological Innovation, & Alternatives to Carbon Taxation” https://skillsgaptrainer.com/report-optimizing-economic-efficiency/

Title: “The leaders of over 1.5 billion+ people in the West, like Europe, UK, Australia, Canada and USA.. LIED to their citizens since 1970 and embedded the lie deep into the philosophy, education, media and workplace.” https://x.com/SkillsGapTrain/status/1887717763046908352

Title: “Restoring Canada’s Destiny: Fixing the Timeline with Canadian Liquefied Natural Gas (LNG), Small Modular Reactors (SMRs), Hybrid Electric Vehicle (HEV) Technologies and Reforestation” https://x.com/SkillsGapTrain/status/1802499440193794175

Title: ‘Misguided Climate Policies or Strategic Economic Sabotage? Analyzing the Impact on Canada’s Economic and Environmental Future‘ https://x.com/SkillsGapTrain/status/1799716240287571985

Title: “Building a Sustainable Future: Integrating Small Modular Reactors, Natural Gas, Hybrid Technologies and Reforestation for Climate Mitigation” https://x.com/SkillsGapTrain/status/1794987859868574173

Title: “The world is at war, much of it being covert economics, media messaging and some proxy wars.” https://x.com/SkillsGapTrain/status/1795250482237379010

Title: “Hello Laurel Collins, Since the NDP has selected you to be the ‘Critic for Environment and Climate Change,.. ‘ https://x.com/SkillsGapTrain/status/1798982572594315305

Title: “The Great Filter Ahead: Engineering a Pathway to Complex Civilizational Survival and Overcoming Cosmic Hurdles” https://skillsgaptrainer.com/the-great-filter-ahead-engineering-a-pathway/

Title: “Building a Sustainable Future: Integrating Small Modular Reactors, Natural Gas, Hybrid Technologies and Reforestation for Climate Mitigation” https://x.com/SkillsGapTrain/status/1794987859868574173

Title: “Natural Gas Hybrid Electric Vehicles with Ultra Light Materials printed by 3D printers can help mitigate Climate Change problems. USA could use Canada’s Natural Gas to create more efficient vehicles!” https://x.com/SkillsGapTrain/status/1867588074613457376

Title: “Towards a Sustainable Future: Integrating Hydrogen, CNG, and Electric Vehicles in Modern Transportation” https://x.com/SkillsGapTrain/status/1818158056431141236

Title: “Enhancing Vehicle Efficiency Through Weight Reduction and Natural Gas Hybrid Systems” https://x.com/SkillsGapTrain/status/1817313442212065628

Title: “Beyond EVs: Top 10 Revolutionary Vehicle Technologies for a Sustainable and Innovative Future” https://x.com/SkillsGapTrain/status/1842412739064410158

Title:“A Better Path for Canada, USA & Europe and Natural Gas Vehicles CNG” https://x.com/SkillsGapTrain/status/1877028626488529154

Title: “History (like WW1 & WW2), shows that Western societies have often destroyed their own achievements by fighting among themselves, such as the destruction of Europe in WW2…” https://x.com/SkillsGapTrain/status/1887654051644420337

To see our Donate Page, click https://skillsgaptrainer.com/donate

To see our YouTube Channel, click https://www.youtube.com/@skillsgaptrainer