As governments around the world double down on aggressive carbon taxation and mandate a rapid shift to renewables, the competitive energy landscape is undergoing seismic changes.

While Brookfield Renewable champions clean power — generating electricity via hydro, wind, solar, and storage — its rise poses a direct challenge to traditional fossil fuel companies.

Yet, the stakes extend far beyond a simple renewable versus oil-and-gas dichotomy. In Canada, a vast array of energy companies and infrastructure assets face the risk of obsolescence, and the economic repercussions could be profound. 😟

🔎 Understanding the Nature of Energy Competition

At its core, energy is fungible. Whether produced by fossil fuels or renewables, what ultimately matters is the unit of usable energy delivered to consumers or industry. Brookfield Renewable does not own pipelines, refineries, or extraction sites — but when policy forces an economic choice between low-carbon electricity and fossil-derived energy, the competition is dollar-for-dollar. Every dollar spent on renewables represents a lost revenue opportunity for companies entrenched in oil, natural gas, and their supporting infrastructures. 💸

📊 Market Share, Investment, and Policy-Driven Shifts

Direct vs. Indirect Competition

-

Direct Competition: Brookfield Renewable directly competes with natural gas-fired power generation. When utilities and industries choose clean power, traditional gas-fired plants lose grid contracts and industrial energy buyers. ⚡

-

Indirect Competition: Infrastructure providers — such as natural gas export pipelines, LNG and oil refining terminals, and oil/gas extraction companies (e.g., Suncor, Cenovus, Tourmaline) — compete at the investment and policy level. As government policies favour low-carbon alternatives, capital flows shift away from these fossil-based assets. 🏗️

Policy Implications: Government mandates and aggressive carbon taxes effectively increase the cost of fossil fuels, pushing market dynamics in favour of renewables. The competitive arena is not defined by who extracts or transports the fuel but by which source can deliver energy at the most attractive price under new environmental standards. 📜

🏭 The Canadian Energy Landscape: Who Stands to Lose?

Canada’s economy has long been intertwined with its robust fossil fuel sector. However, the renewable revolution — exemplified by companies like Brookfield Renewable — throws into sharp relief a critical issue: the survival of Canada’s oil and gas infrastructure. Consider the following sectors, many of which are now at risk:

-

Natural Gas Export Pipelines: Providers such as TC Energy’s Coastal GasLink and Enbridge’s pipeline systems have built their business on moving fossil fuels. While Brookfield Renewable doesn’t compete directly here, policy shifts that favour renewables could indirectly diminish demand for LNG and pipeline services. 🚇

-

LNG and Refining Terminals: Facilities like Kitimat LNG and LNG Canada, designed to liquefy and export natural gas, face potential market contraction if renewables displace traditional fuel usage. The role of refining terminals in converting natural gas and crude oil becomes less central as clean electricity gains prominence. 🛢️

-

Oil Pipelines and Export Infrastructure: Major pipelines (e.g., Trans Mountain, Enbridge’s Line 3) that transport crude oil both domestically and for export risk losing relevance as investor confidence shifts toward low-carbon technologies. 🛣️

-

Oil and Gas Extraction Companies: Traditional giants — Suncor, Cenovus, Canadian Natural Resources Limited, along with emerging players like Tourmaline and ARC Resources — face competitive pressure not from a product mismatch, but from an overall energy market shift. The battle for market share intensifies as renewables capture a larger slice of the grid contracts and industrial power procurement. ⛽

-

Natural Gas-Fired Power Generation: Perhaps the most direct rivalry, gas-fired plants are already competing with Brookfield’s renewable generation for grid contracts. In regions like Alberta, where natural gas has powered decades of growth, this competition is especially pronounced. 🔌

A Broader Reality for Canada: The narrative that Canada’s energy future hinges solely on renewables like Brookfield Renewable overlooks a hard truth: for the last 10 years, oil and gas have underpinned much of Canada’s economic strength. With key economic metrics spiralling and investment fleeing — fuelled in part by policy uncertainty and an increasingly unattractive fiscal climate — there is growing concern that without a balanced energy mix, Canada’s prosperity is at risk. Rumours even suggest that Brookfield’s head office relocation to the USA signals an intention to shift revenues away from Canada, deepening the national economic challenge. 🇨🇦➡️🇺🇸

📈 Economic Implications: A Nation at a Crossroads

Canada’s reliance on its fossil fuel sector has provided vital revenue, employment, and export earnings for decades. However, aggressive carbon policies and a global pivot to renewables are stirring several economic challenges:

-

Loss of Investment: Reports indicate that Canada has seen hundreds of billions in cancelled or suspended energy projects. The capital that once fuelled the nation’s oil sands, LNG terminals, and pipeline expansions now risks diversion abroad — resulting in job losses, stagnant GDP growth, and weakened infrastructure development. 😟

-

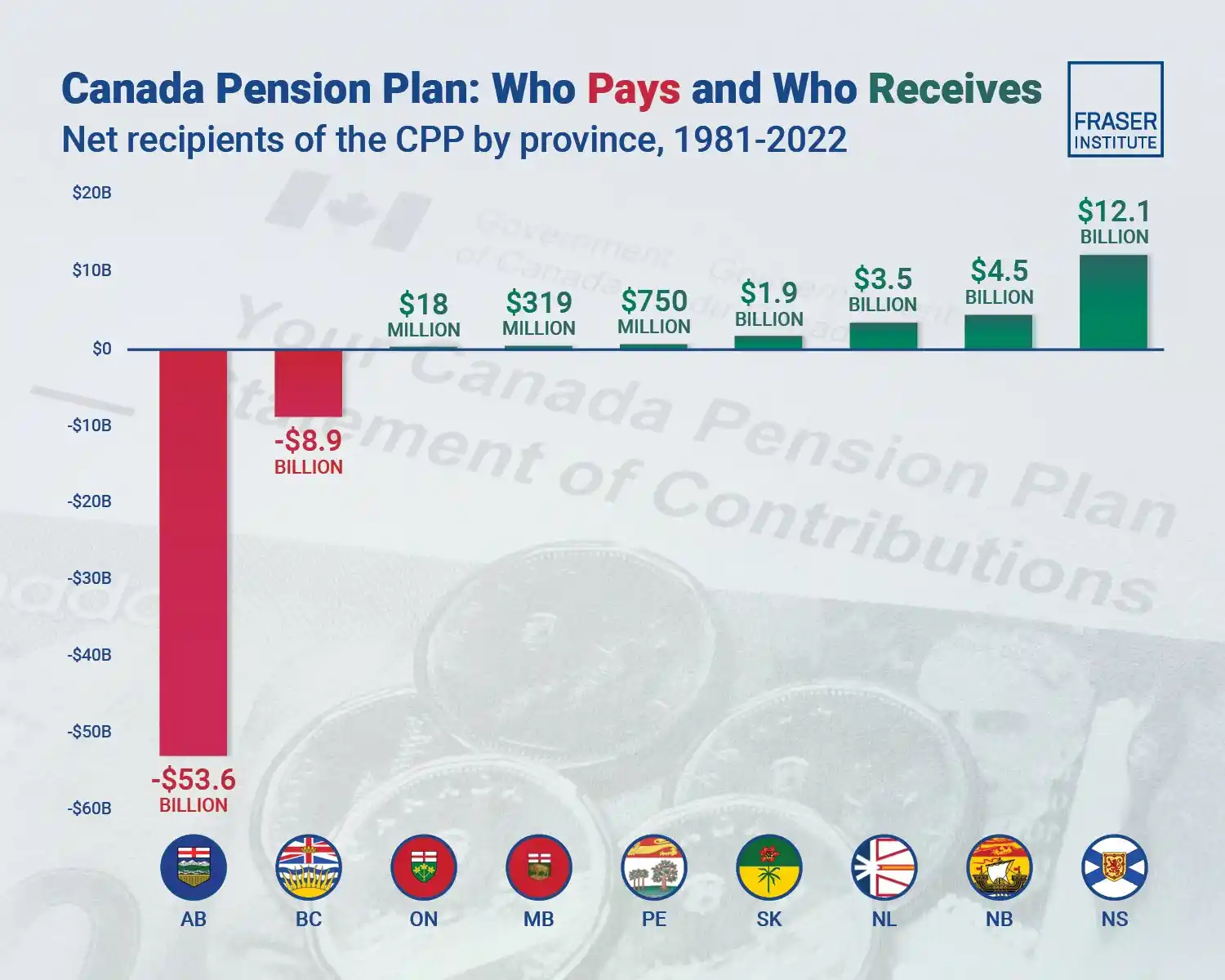

Capital Flight and Reduced FDI: With policies that many investors find unfavourable, Canada has experienced significant capital flight. The stock market’s decoupling from the robust U.S. market (68.5% less value since 2015) (https://x.com/SkillsGapTrain/status/1904283621298778530), further exacerbates the situation, leaving Canadian equities ~flat-lined and eroding retirees’ and pensioners’ wealth. 💔

-

Currency Depreciation: The Canadian dollar has lost a notable portion of its purchasing power over the last decade. As revenue streams from the oil and gas sector dwindle, the nation’s international purchasing power — and by extension, its economic sovereignty — comes under severe pressure. 📉

-

Strategic Vulnerability: Without a healthy fossil fuel industry, Canada’s capacity to secure energy independence diminishes. This could lead to a scenario where, despite impressive strides in renewables, the nation finds itself strategically and economically dependent on foreign powers for its energy needs: CCP/China, USA, Europe & Corporate Alliances Ex: WEF. 🔒

🔮 Future Outlook: Navigating a Dual Energy Economy

In a policy-driven clean-energy future, the traditional energy giants in Canada face a profound strategic choice: transform or risk obsolescence. Brookfield Renewable’s rise represents the growing tide of renewables — a tide that, if left unchecked, could erode the foundational economic base built by oil and gas. However, the solution need not be binary. A balanced approach — where renewable growth coexists with a robust, reformed fossil fuel sector — may be essential for national prosperity.

-

Investment Diversification: It is crucial for policymakers to encourage investments that modernize fossil fuel operations with cleaner technologies rather than completely sidelining them. This strategy could help preserve the jobs, infrastructure, and revenues that have long supported Canada’s economic engine. 💡

-

Policy Recalibration: Reassessing aggressive carbon taxation and regulatory frameworks to safeguard key energy sectors might provide the necessary breathing room for Canada’s economy to transition without severe disruption. Finding a middle ground could prevent a scenario where the renewable surge inadvertently weakens the pillars of Canadian prosperity. ⚖️

-

National Dialogue: With so many facets of Canada’s energy infrastructure at stake — from pipelines and LNG terminals to extraction companies and power plants — a national conversation is urgently needed. Such dialogue should focus on forging a path that balances environmental responsibility with economic resilience and national security. 🗣️

✅ Conclusion: A Call for Balanced Energy Policy

In a future where policy forces a stark choice between fossil fuels and renewables, Brookfield Renewable indeed competes dollar-for-dollar with oil and gas. Yet, the stakes are far higher than market share alone. Canada’s economic fabric — woven through decades of fossil fuel investment, infrastructure, and export strength — is at risk. Without a thoughtful, balanced energy strategy that preserves and modernizes its traditional sectors while embracing renewables, Canada may face significant economic and strategic vulnerabilities. 🇨🇦⚠️

For Canada to not only survive but thrive in this transformative era, decision-makers must recognize that the nation’s prosperity depends on more than just the clean energy revolution. It demands that we protect and evolve the full spectrum of our energy infrastructure — ensuring that, as the world moves toward sustainability, Canadian industries remain competitive, investments are retained, and national sovereignty is upheld. 🌟

This comprehensive analysis underscores that while Brookfield Renewable symbolizes the future of clean energy, the challenges and risks to Canada’s traditional fossil fuel sectors — and the broader economic implications — must not be ignored. A balanced, pragmatic approach is essential to ensure Canada’s energy security and long-term prosperity. 🔑

Title: “Mark Carney Orchestrated USA $10 Billion Dollar PIPELINE Acquisition IMMEDIATELY Before RUNNING!” https://youtu.be/JdbhO3BJ9DQ?feature=shared

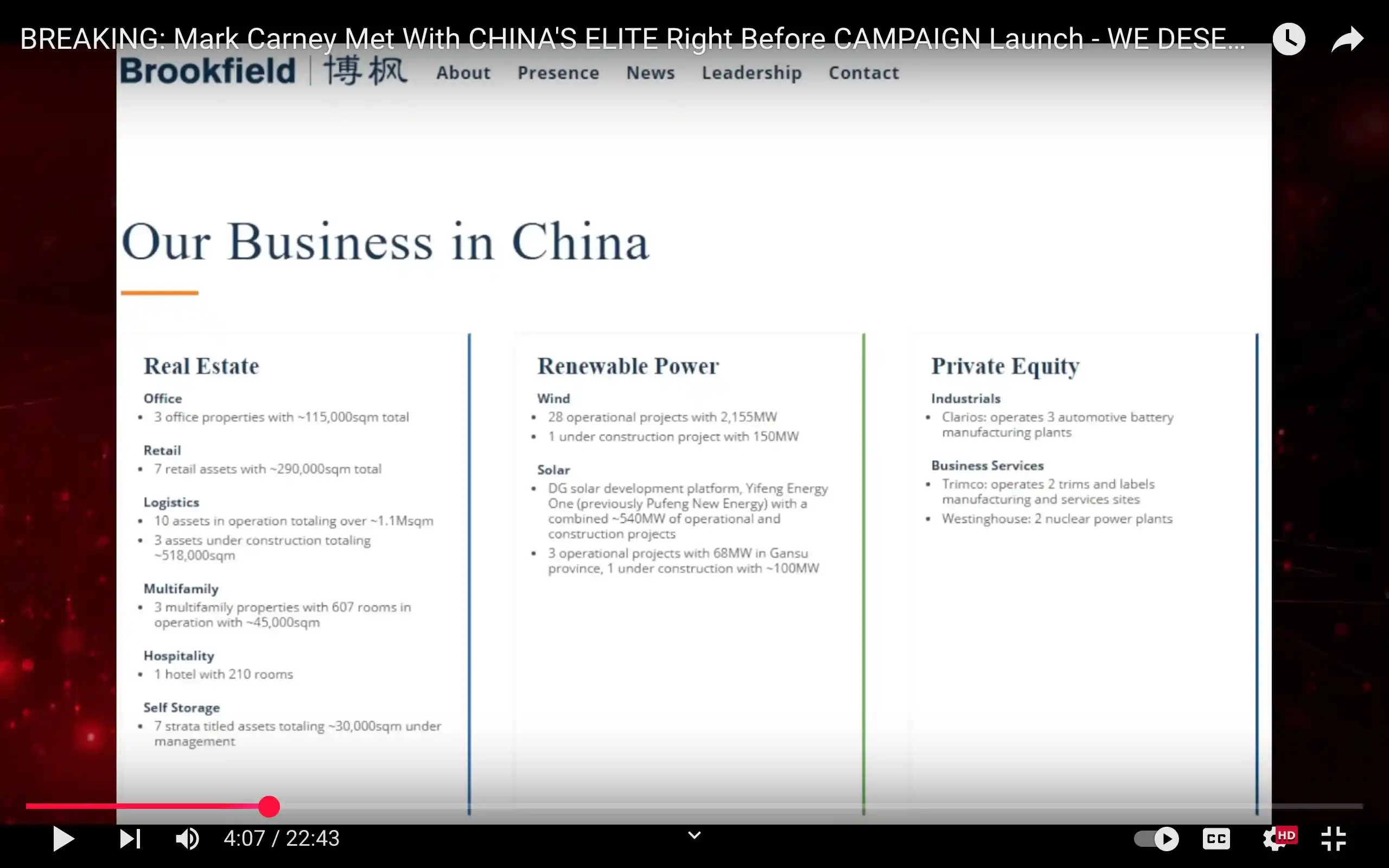

Title: “BREAKING: Mark Carney Met With CHINA’S ELITE Right Before CAMPAIGN Launch – WE DESERVE ANSWERS! https://youtu.be/S_sixRnGTMs?feature=shared

Title: “Will Canada Collapse OR Become the Most Powerful Country of the Century?” https://youtu.be/ggzIhSs3IWM?feature=shared

Title: “Mark Carney’s housing scheme could make Brookfield BILLIONS” https://youtu.be/44OT-oiV5Wo?feature=shared

Appendix A: Understanding Brookfield Asset Management’s Shareholder Structure and Global Interests 🌐

Overview of Brookfield’s Complex Structure

Brookfield Asset Management Inc. is often mistakenly conflated with its subsidiary, Brookfield Renewable Partners. While Brookfield Renewable focuses specifically on clean energy generation — hydro, wind, solar, and energy storage — Brookfield Asset Management (BAM) itself is a global investment firm with extensive interests spanning real estate, infrastructure (including pipelines and energy assets), private equity, and asset management. This distinction is critical because it clarifies the broader implications of Brookfield’s operations and influence.

Shareholder Composition & Internal Interests 📈

Brookfield Asset Management’s shareholder base is diversified and international, including large institutional investors, pension funds, sovereign wealth funds, and individual stakeholders. Key institutional shareholders include major Canadian and U.S. pension funds (e.g., Canada Pension Plan Investment Board, Ontario Teachers’ Pension Plan), sovereign wealth entities (e.g., Middle Eastern and Asian state funds), and significant American institutional investors such as BlackRock and Vanguard.

Furthermore, executives and senior management at Brookfield commonly hold substantial stakes in the company through shares, stock options, and private investment vehicles. This internal alignment of incentives underscores the inter-connectedness between individual management decisions and broader corporate strategy, shaping the company’s global financial orientation.

International Headquarters & Revenue Implications 🇺🇸🇨🇦

In recent strategic moves, Brookfield relocated its primary corporate headquarters from Canada to the United States, specifically New York. While this move may primarily reflect operational preferences, market positioning, and tax strategy, it implicitly signals a potential shift in corporate emphasis — and eventually, financial flows — away from Canada. Revenue generated by Canadian operations could increasingly be consolidated or strategically managed within the U.S. jurisdiction, potentially impacting Canada’s economic interests over time.

Global Debt Exposure & Sovereignty Concerns 🌎💸

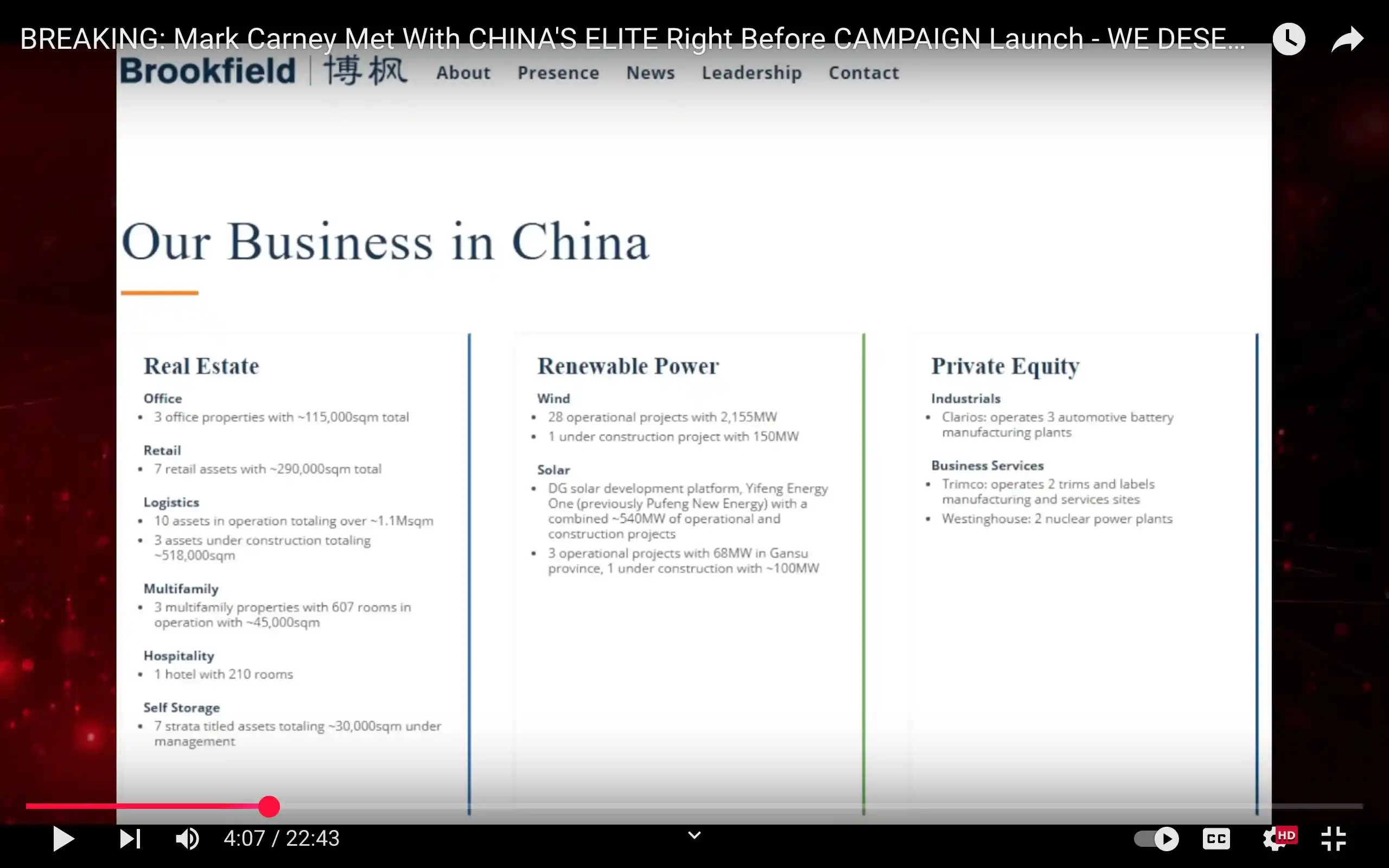

Brookfield’s international operations come with substantial financial leverage, including debt sourced globally. The company maintains significant borrowing relationships not only with North American institutions but also with Asian (particularly Chinese), European, and Middle Eastern financial institutions. This global debt network means Brookfield has obligations extending beyond Canada’s borders, raising legitimate questions about financial sovereignty, particularly regarding exposure to Chinese and international lending.

Strategic Implications for Canada 🇨🇦⚠️

Understanding Brookfield Asset Management’s broader role helps contextualize the competitive dynamics facing Canada’s fossil fuel industry. Although Brookfield Renewable directly challenges fossil fuel companies within Canada’s energy sector, Brookfield Asset Management’s broader global strategy — driven by diverse, international financial stakeholders and creditors — potentially positions the company in a less nationally aligned stance. The implications could extend to reduced investment in Canada’s domestic economy, strategic asset reallocations, and altered national financial stability, especially if Canada’s fiscal and regulatory environment becomes less attractive relative to international markets.

Conclusion: Sovereignty and Economic Stability 🏛️

Brookfield Asset Management’s corporate structure, global financial ties, and strategic repositioning underscore an urgent need for policymakers and stakeholders in Canada to closely examine the interplay between corporate decisions, national economic interests, and sovereignty. While renewable energy remains a cornerstone of Canada’s sustainable future, the broader implications of Brookfield’s corporate maneuvers and international obligations must not be overlooked in shaping a comprehensive, balanced Canadian energy policy.

Appendix B: Key Context and Allegations Surrounding Carney’s Rise to Liberal Leader and Potential Conflicts of Interest

-

Carney Becomes Liberal Leader After Trudeau Steps Down The transcripts indicate that Justin Trudeau stepped aside, and Mark Carney quickly emerged as the new Liberal leader and eventually Prime Minister. Critics claim this happened with minimal transparency about Carney’s personal finances and assets, which has raised conflict-of-interest concerns. Reporters noted that Carney had 60 days after being sworn in to disclose his financial holdings to Canada’s ethics commissioner, and 120 days before those disclosures would be public — meaning the election campaign would end before voters ever saw them.

-

Deep Connections to Brookfield Asset Management Mark Carney was Vice Chair and then Chair of Brookfield Asset Management, one of the world’s largest investment firms. During his time there, Brookfield made major investments worldwide, including in China and the United States. Almost immediately before Carney ran for the Liberal leadership, Brookfield secured a large loan from the Bank of China (roughly a quarter billion dollars), and Carney personally lobbied the mayor of Beijing to “deepen cooperation.” Critics point to this timing, plus Carney’s friendships with Brookfield’s top executives, as fuelling questions about whether he is “beholden to China.”

-

Meetings With Chinese Officials and Investments in China While serving as Brookfield’s Chair, Carney traveled to Beijing on multiple occasions, met with high-level Chinese government leaders (including Xi Jinping and the mayor of Beijing), and promoted Brookfield’s plan to expand investments in China. These meetings occurred within a larger context in which Canada’s own government was censoring or criticizing Chinese trade practices. Observers therefore question why Carney, set to become Liberal leader, was simultaneously pushing deeper ties and new capital projects in China.

-

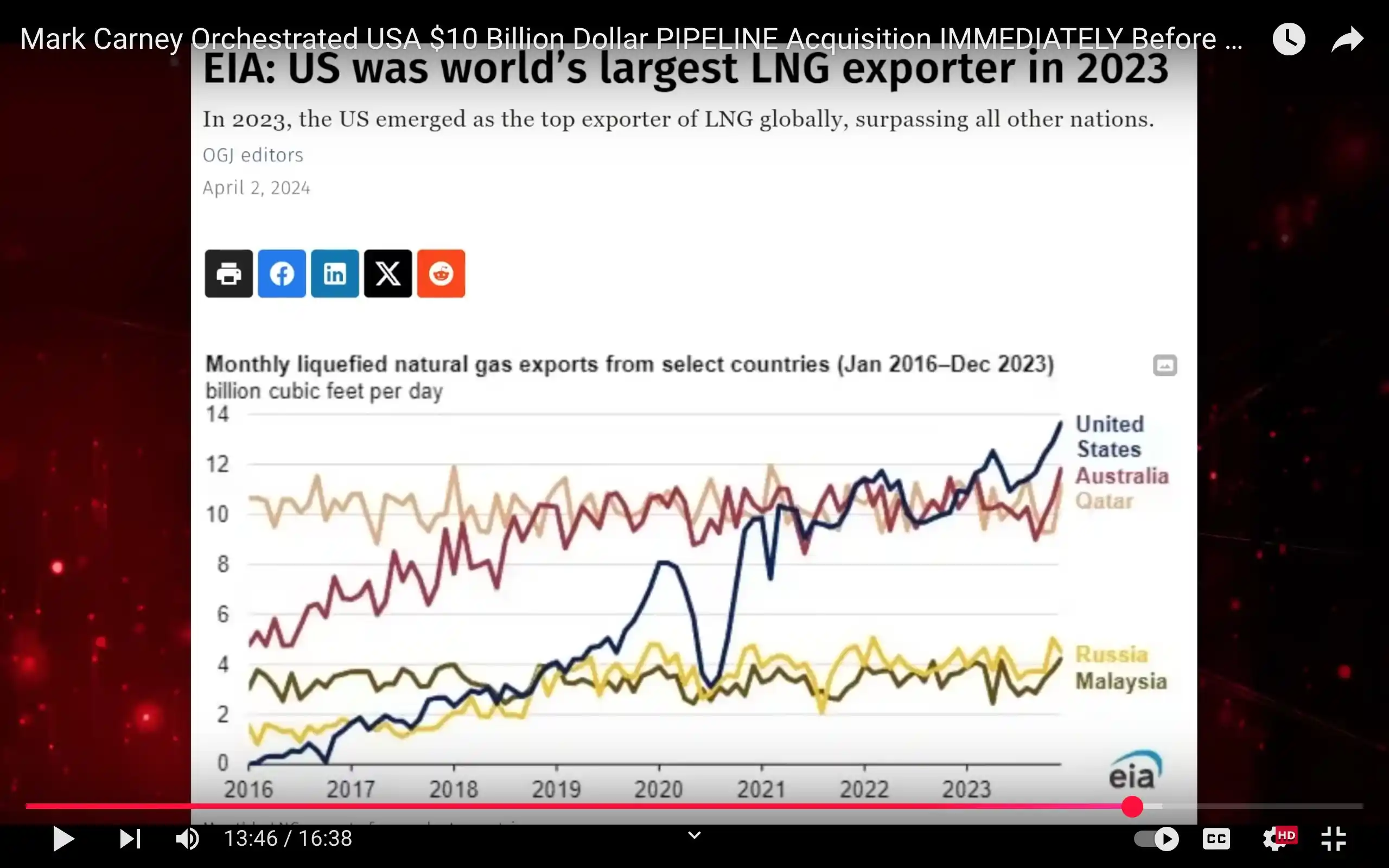

Pipeline Controversies As Brookfield Chair, Carney helped orchestrate major pipeline deals outside Canada — most notably, a reported $10 billion acquisition of the U.S.-based Colonial Pipeline. Meanwhile, he supports keeping in place Canadian legislation (Bill C‑69) often blamed for blocking or slowing new pipelines in Canada. This fuels accusations that Carney is happy to profit from pipelines abroad while restraining pipeline expansion at home, hurting Canadian energy jobs and the domestic economy.

-

Housing Plan That Potentially Benefits Large Developers More recently, Carney proposed a sweeping national housing scheme in which government agencies would partner with private firms to build large-scale rental units (rather than boosting home ownership). One of Brookfield’s divisions is a major landlord and rental-housing manager, so critics warn that Carney’s housing plan, if ever enacted, could funnel billions in public financing or favourable treatment to large institutional developers — including Brookfield.

-

Alleged Larger Strategy and Conflicts of Interest Throughout the videos and articles, the overarching allegation is that Mark Carney’s activities — lobbying in China, refusing to build pipelines in Canada while building them elsewhere, and launching massive government-led housing projects — may align more with his global investment interests than with serving Canadians’ best interests. Critics say Carney has not clearly disclosed which personal holdings he retains from Brookfield, raising concern that he could personally profit from Liberal government decisions he directs as Prime Minister.

Overall, this article portray Carney as a financial figure who quickly took over the Liberal Party’s leadership and is now shaping major government policies in ways that may benefit his longstanding ties to Brookfield and its overseas ventures. The key questions revolve around:

-

Disclosure of Carney’s financial assets,

-

Extent of his personal stake in Brookfield’s various projects,

-

Why he meets and negotiates with Chinese officials while Canada’s own diplomatic stance is often at odds with Beijing,

-

Contradictions in backing pipeline investments abroad but leaving Bill C‑69 in place at home, and

-

Who truly profits from a giant, government-subsidized housing expansion that seems to emphasize large corporate landlords over Canadian families’ home-ownership.

Appendix C: Potential Mechanisms by Which Carney & Brookfield May Shift Investment from Canadian Fossil Fuels to Overseas Ventures

Below is a more detailed look at the mechanisms critics say Mark Carney and Brookfield might use to shift investment away from Canada’s fossil fuel sector and toward their own international or renewable ventures. By spelling them out step-by-step, we can see how Canadian policy or funding might be redirected — thereby benefiting Brookfield’s assets in the U.S., China, and beyond.

1. Shaping Policy to Restrain Canadian Competitors

-

Bill C‑69 & Other Regulatory Hurdles Mechanism: Keep stringent rules on new pipeline or resource projects — like Bill C‑69, which industry critics claim makes large-scale energy infrastructure in Canada nearly impossible to approve quickly. Effect: Domestic fossil fuel developers (especially in Alberta) face higher costs and longer timelines, discouraging new investments or expansions. Carney, with influence over the governing party, is perceived to support or preserve these rules. Outcome: By restraining competitors at home, Brookfield’s global pipeline investments (e.g., Colonial Pipeline in the U.S.) or green projects stand a better chance of gaining market share without competition from new Canadian oil-and-gas projects.

-

Aggressive Carbon Pricing or Caps on Emissions Mechanism: Tighten carbon taxes, raise emissions caps, and apply more environmental compliance costs. Effect: Makes Canadian oil and gas less profitable. Shutters potential expansions or forces companies to scale back. Outcome: Shifts demand toward alternative energy sources, many of which Brookfield invests in — particularly overseas.

2. Steering Public Dollars to “Green” Ventures Brookfield Controls

-

Government Subsidies & Financing Mechanism: A big push for “green stimulus,” special financing for renewables, or a massive “public-private partnership” (PPP) that pumps taxpayer money into projects that Brookfield or affiliates would own. Effect: While local fossil-fuel firms get hammered by regulations, Brookfield’s clean-energy or infrastructure divisions receive fresh capital and low-interest loans — often from the same government Carney leads. Outcome: Brookfield’s renewable assets (including those based partly in the U.S.) gain stable returns funded by Canadian taxpayer-subsidized programs, even though the ultimate growth or corporate “headquarters” might be located abroad.

-

Creating New Entities That Channel Contracts Mechanism: As part of a flagship government plan (e.g., a giant federal housing or infrastructure agency), the government gives “preferred vendor” status to large private partners — potentially including Brookfield. Effect: These big contracts go to favoured insiders. Brookfield’s portfolio (renewables, real estate, or otherwise) swells due to guaranteed business or minimal risk. Outcome: Broader public resources end up boosting Brookfield’s bottom line, with no net benefit to the fossil fuel regions in Canada.

3. Relocating Profits & Operations to the U.S. or China

-

Moving Brookfield Headquarters Mechanism: Brookfield relocates or centralizes its main office in New York, capitalizing on friendlier financial markets, corporate tax structures, or better deals. Effect: Revenue streams and future expansions, originally grown from Canadian investor money and government contacts, end up recorded in the United States. Outcome: Canada loses tax revenue, spin-off business, and high-value jobs. Meanwhile, Brookfield invests in profitable U.S. pipelines or Chinese ventures — far from the regulatory environment they help shape at home.

-

Expanding in China Mechanism: Carney lobbies Beijing’s mayor or CCP officials, seeking partnerships and loans (like the Bank of China deal). Brookfield invests in Chinese real estate, green energy, or infrastructure. Effect: With fewer regulatory barriers (for Brookfield’s deals abroad) and a massive consumer market in China, these ventures may be more lucrative than battered Canadian fossil fuel projects. Outcome: Value created by partnerships or “green deals” partially financed from Canada’s climate push flows to Brookfield’s Chinese expansions. Canadian resource companies can’t compete in that realm, stifled by tight domestic rules.

4. Personal Financial Gain & Conflicts of Interest

-

Carney’s Undisclosed Assets Mechanism: As Prime Minister, Carney is widely believed to hold shares or have deep financial ties to Brookfield. Because of Canada’s ethics rules, the public disclosure might be delayed. Effect: Voters can’t see how his private net worth could rise from, for example, Brookfield’s pipeline or renewable expansions — nor do they see if he benefits when Canadian fossil-fuel competitors are constrained. Outcome: Policy choices that appear to be “green leadership” might also serve Carney’s personal stake in Brookfield’s overseas growth.

-

Influencing Federal Approvals or Loan Terms Mechanism: If Carney’s cabinet or allied officials favor projects that complement Brookfield’s portfolio — like guaranteed “green energy purchasing deals” or beneficial financing terms — Brookfield’s share price can climb. Effect: The lines blur between official government policy and business strategies that enrich Carney and Brookfield’s partners. Outcome: Potential conflict of interest allegations: the same person shaping policies (Carney) can profit from them if he still has direct or indirect holdings.

Putting It All Together

-

Restrict Canada’s fossil fuels with high regulation and carbon taxes → hamper domestic competition.

-

Fund green projects heavily with taxpayer dollars → direct that money via PPPs and “green stimulus” to Brookfield ventures, at home or abroad.

-

Relocate significant Brookfield operations to the U.S. or expand in China → leverage bigger markets, easier regulatory climates, and cheap capital.

-

Delay or conceal Carney’s personal holdings → hamper public scrutiny until after key elections or policy decisions.

Net Result: Canada’s oil-and-gas sector stagnates, while Brookfield’s pipeline and renewable assets outside Canada thrive. Over time, critics say this diverts wealth, jobs, and valuable investments away from Alberta and other Canadian regions. In short, Carney’s dual roles in shaping government policy and guiding Brookfield’s global strategies — combined with the relocation of Brookfield’s headquarters — could be driving capital out of Canada’s fossil fuels and into Brookfield’s overseas holdings, all while using Canadian regulatory and fiscal tools to stack the deck.

This is the gist of how observers who are critical of Mark Carney’s influence piece together the “mechanics” by which Canada’s fossil fuel sector loses out — and Brookfield’s (and thus potentially Carney’s personal) bottom line gains — under the policies he helps enact.

Appendix D: Verified Statements from ‘Renewable Titans vs. Fossil Giants’

-

As governments around the world double down on aggressive carbon taxation and mandate a rapid shift to renewables, the competitive energy landscape is undergoing seismic changes.

-

While Brookfield Renewable champions clean power — generating electricity via hydro, wind, solar, and storage — its rise poses a direct challenge to traditional fossil fuel companies.

-

The stakes extend far beyond a simple renewable versus oil-and-gas dichotomy.

-

In Canada, a vast array of energy companies and infrastructure assets face the risk of obsolescence, and the economic repercussions could be profound.

-

At its core, energy is fungible in market terms. Whether produced by fossil fuels or renewables, what ultimately matters is the usable energy delivered to consumers or industry.

-

Brookfield Renewable does not own pipelines, refineries, or extraction sites — but when policy forces an economic choice between low-carbon electricity and fossil-derived energy, the competition becomes direct in dollar terms.

-

Every dollar spent on renewables can represent a lost revenue opportunity for companies entrenched in oil, natural gas, and their supporting infrastructures.

-

Brookfield Renewable directly competes with natural gas-fired power generation. When utilities and industries choose clean power, gas-fired plants lose grid contracts and industrial energy buyers.

-

Infrastructure providers — such as natural gas export pipelines, LNG and oil refining terminals, and oil/gas extraction companies (e.g., Suncor, Cenovus, Tourmaline) — compete at the investment and policy level.

-

As government policies favour low-carbon alternatives, capital flows shift away from these fossil-based assets.

-

Government mandates and aggressive carbon taxes effectively increase the cost of fossil fuels, pushing market dynamics in favour of renewables.

-

The competitive arena is defined less by who extracts or transports fuel and more by which source delivers energy at the lowest cost under environmental standards.

-

Canada’s economy has long been intertwined with its robust fossil fuel sector.

-

The renewable revolution — exemplified by companies like Brookfield Renewable — highlights a critical issue: the long-term viability of Canada’s oil and gas infrastructure.

-

Providers such as TC Energy’s Coastal GasLink and Enbridge’s pipeline systems have built their business on moving fossil fuels.

-

While Brookfield Renewable doesn’t compete directly in pipelines, policy shifts favouring renewables could reduce demand for LNG and pipeline services.

-

Facilities like Kitimat LNG and LNG Canada, designed to liquefy and export natural gas, could face market pressure if renewables reduce traditional fuel demand.

-

Refining terminals used to convert natural gas and crude oil become less central as electricity gains market share.

-

Major pipelines (e.g., Trans Mountain, Enbridge’s Line 3) may see declining investor confidence amid low-carbon policy shifts.

-

Companies like Suncor, Cenovus, Canadian Natural Resources Limited, Tourmaline, and ARC Resources face market pressures due to broader energy transition trends.

-

Gas-fired plants are already competing with Brookfield’s renewable generation for grid contracts. In Alberta, this competition is significant.

-

Over the past 10 years, oil and gas have been key pillars of Canada’s economic strength.

-

Declines in investment and project cancellations have been partially driven by policy uncertainty and fiscal changes.

-

Brookfield’s shift of key operations to the U.S. may reflect a broader strategy to access global capital markets and manage tax exposure.

-

Canada has experienced major project cancellations, totalling in the hundreds of billions, including oil sands and LNG infrastructure.

-

Capital outflows have occurred, with some linked to perceptions of an unfavourable investment environment.

-

While still strongly tied to the U.S., Canada faces risks if its economy diverges from American market growth.

-

Canadian equities have under-performed U.S. markets in recent years, affecting pension and investment portfolios.

-

The Canadian dollar has lost purchasing power over the last decade, reducing economic leverage globally.

-

Canada’s energy independence depends significantly on its fossil fuel production.

-

Strategic vulnerabilities could emerge if Canada grows reliant on foreign nations or multilateral corporate alliances for core energy needs.

Appendix E: Alberta Fossil Fuel Industry, Last Sovereignty Support Pillar

Related Content:

Title: “Matrix 2.0: Humanity’s Last Stand — Or Greatest Comeback” https://x.com/SkillsGapTrain/status/1907377056297750548

Title: “The Real Cost of Trudeau–Carney–Liberal Party: Not Just Half a Trillion — But Canada’s Future” https://x.com/SkillsGapTrain/status/1904283621298778530

Title: “Canada’s Wake-Up Call: Boosting Our Economic Future” https://x.com/SkillsGapTrain/status/1903347092611010570

Title: “The Cost of Carbon: Financial Risks for Canada’s Surface Combatant Project”

Title: “Canada’s Energy Ambitions: Can Doubling Exports Propel It to Global #1?” https://x.com/SkillsGapTrain/status/1899681877902127494

Title: “Revolutionizing Energy Resilience: Harnessing Distributed Micro Reactors for Urban & National Security” https://x.com/SkillsGapTrain/status/1896073529398837497

Title:“Navigating the Crossroads of Crisis: A Comprehensive Comparative Analysis of Canadian Policy Platforms in an Era of Global Turbulence” https://x.com/SkillsGapTrain/status/1895276437172810181

Title: “Canada at a Crossroads in 2025: A Comprehensive Academic Examination of 20 Interconnected Crises” https://x.com/SkillsGapTrain/status/1892617544013435132

Title: “Strengthening Canada’s Energy Exports from Coast to Coast: How Canada’s Oil & LNG Infrastructure Can Mitigate Hyperinflation Risks” https://x.com/SkillsGapTrain/status/1887965732102631567

Title: “The CARBON TAX as a Foundational Barrier to Canada’s Prosperity and Sovereignty” https://x.com/SkillsGapTrain/status/1881111114265850046

Title: “Back to 1986 // The Retrowave & Synthwave Experience | Vaporwave | Chillwave” https://youtu.be/XZg1ZDfYZu8?feature=shared

To see our Donate Page, click https://skillsgaptrainer.com/donate

To see our Instagram Channel, click https://www.instagram.com/skillsgaptrainer/

To see some of our Udemy Courses, click SGT Udemy Page

To see our YouTube Channel, click https://www.youtube.com/@skillsgaptrainer