1. Objective

To assess whether the compensation of CBC executives (CEO and VPs) is justified based on the organization’s private market revenue generation, excluding government subsidies. The analysis compares CBC executive pay with private sector benchmarks for companies generating similar levels of self-sourced revenue.

2. CBC Executive Compensation Overview

CEO Salary: $472,900 – $623,900 annually (total compensation).

VP Salary: $311,000 – $686,500 annually (total compensation).

2.1. CBC Revenue Context

Total Revenue (2022 – 2023): $1.9 billion.

Self-Generated Revenue: $250 – $500 million annually from advertising, licensing, and other commercial sources.

Government Funding: ~70% of total revenue (excluded for this analysis).

2.2. Private Sector Comparison

Revenue Benchmark: Private companies with annual revenues of $250 – $500 million.

Median Executive Pay for Comparable Private Sector Companies:

CEO Pay: $300,000 – $500,000 annually.

VP Pay: $150,000 – $300,000 annually.

2.3. Key Drivers of Private Sector Pay:

Revenue Growth: Performance tied to competitive revenue generation.

Profitability: Higher executive pay is justified by net income.

Market Dynamics: Private firms face competition without subsidies.

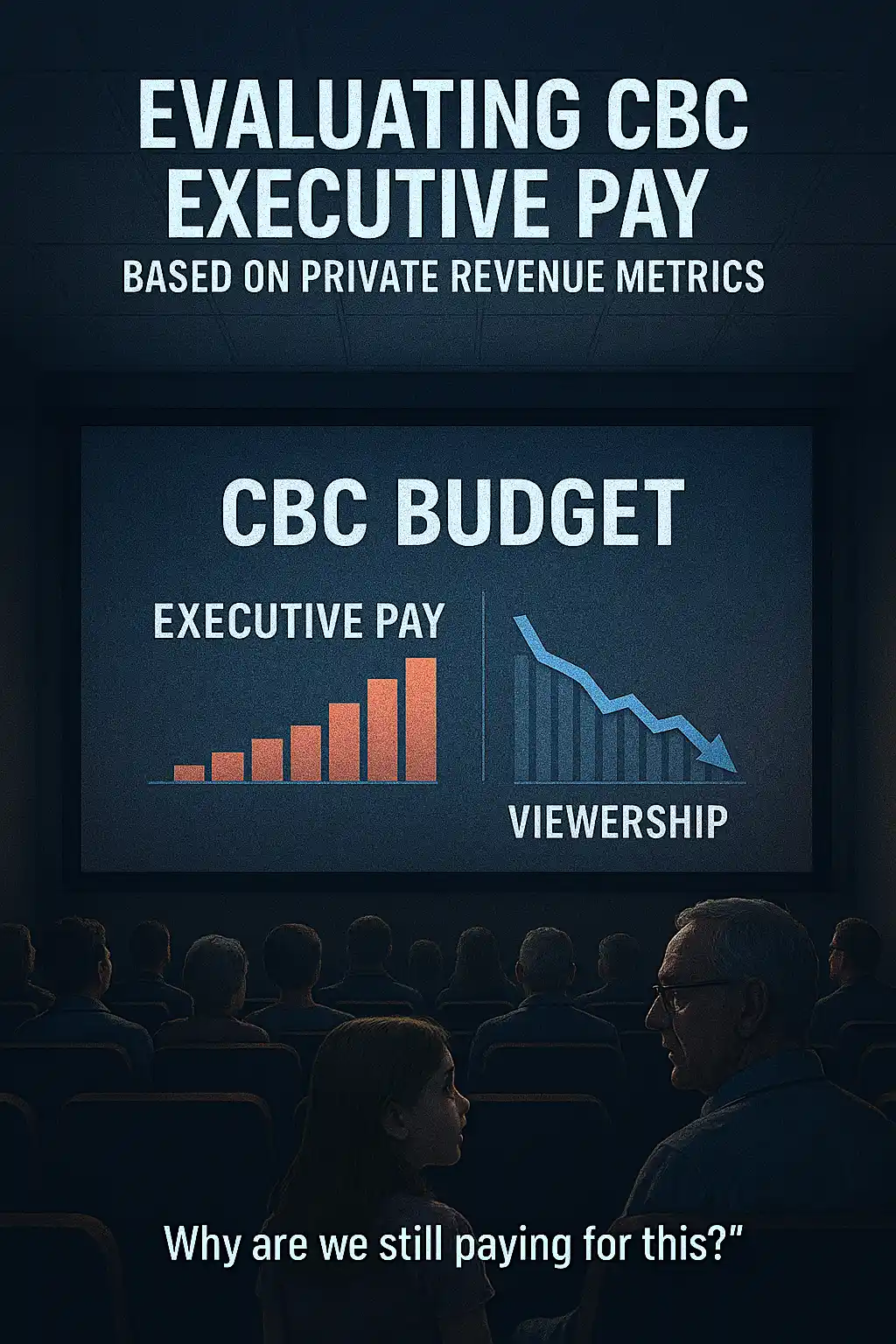

3. Findings

3.1. CEO Pay Comparison

CBC CEO pay ($472,900 – $623,900) is 15 – 24% higher than the private sector median.

Reduction Target: CEO pay should be $100,000 – $150,000 lower to align with private sector benchmarks.

3.2. VP Pay Comparison

CBC VP pay ($311,000 – $686,500) is 20 – 50% higher than private sector median ranges.

Reduction Target: VP pay should be $100,000 – $300,000 lower, depending on specific responsibilities.

3.3. Proposed Adjustments

CEO Pay: Adjust to $350,000 – $450,000 annually. Reflects competitive market standards for revenue levels without profitability.

VP Pay: Adjust to $150,000 – $300,000 annually. Reflects private sector standards for companies with $250 – $500 million in revenue.

4. Recommendations

If CBC executive compensation were aligned solely with private revenue performance:

CEO pay would decrease by ~$100,000 – $150,000.

VP pay would decrease by ~$100,000 – $300,000.

These adjustments reflect market-driven standards and exclude subsidies, ensuring accountability to taxpayers and a fair correlation between performance and pay.

Gradual Reduction in Government Funding: Start with a 50% reduction in government funding to incentivize efficiency and innovation while maintaining core public service functions.

Diversify Revenue Streams: Invest in streaming services and subscription models.

Leverage international licensing of CBC-produced content.

Operational Efficiency: Reduce executive compensation to align with private sector benchmarks.

Focus on high-impact, revenue-generating content while scaling back on low-revenue programming.

Evaluate Public Mission: Reassess CBC’s public service mandate. If certain functions (e.g., underserved regional programming) are critical, they could be subsidized separately from the core operating budget.

5. Conclusion

0% government funding for the CBC is not immediately feasible without major structural changes and significant revenue growth.

However, reducing government dependency over time is achievable through diversification of revenue streams, operational efficiencies, and a redefined public service mandate.

This approach would ensure CBC evolves into a sustainable and competitive entity while maintaining elements of its public broadcasting mission.

Related Content:

To see our Donate Page, click https://skillsgaptrainer.com/donate

To see our YouTube Channel, click https://www.youtube.com/@skillsgaptrainer